|

| |

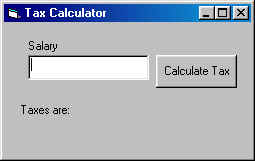

- Create a new form, in your Unit 3 database do not attach a table to it.

- Change the Caption of the form to display, Tax Calculator

- Turn Record Selectors, Navigation Buttons and Dividing Lines to No

- Turn Auto Centre to Yes.

- Change the Width to 4 inches.

- Change Scroll Bars to none

- Save the form with the Name of Lesson3Exercise1.

- Create a form as shown, remember to use appropriate names for variables and objects and

to include comments.

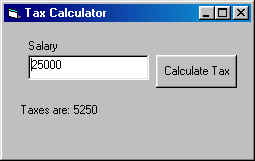

- When the Calculate Tax button is clicked, you want to check to make sure a

number is entered into the textbox. If there is a number, then the taxes are calculated as

follows:

If Salary is less or equal to $20,000 the tax is simply 20% of the Salary.

If Salary is greater than $20,000 and less than or equal to $50,000 the tax is $4000

plus 25% of the Salary minus $20,000.

If Salary is greater than $50,000 the tax is $11500 plus 35% of the Salary minus

$50,000.

|