Technologies

Extensible Markup Language (XML) -

enabling technology that provides a common data format for suppliers and

buyers. Commerce One has made XML its standard for application development.

By acquiring Veo Systems Inc., Commerce One has advanced its XML effort

to the forefront. CommerceNet, an e-commerce consortitum uses Veo's Common

Business Library (CBL) to establish the eCo Framework. This initiative

deals with the ever-growing complement of electronic commerce relatedspecifications,

including Catalog Information Specification, Channel Definition Format

(CDF), Common Business Library(CBL), Electronic Data Interchange (EDI),

Internet Content Exchange (ICE), Open

Buying on the Internet (OBI), Open Financial

Exchange (OFX), Open Trading Protocol (OTP), and XML.

Benefits of XML:

-

Businesses can describe services in a manner

that can be widely understood

-

One set of documents, forms and messages can

be exchanged by businesses with different internal business systems

-

Errors in re-keying data are reduced because

data can be transformed through gateways

-

Frequent changes in business process can be

handled without substantial engineering cost

-

Leverages investment in legacy systems and

can be used with latest Internet technology

Meanwhile, Ariba Technologies has adopted

Commerce XML (cXML) document type definitions to facilitate Internet transaction

processing. XML is considered a broader, updated approach to reflect the

World Wide Web Consortium's efforts. cXML is designed to be a set of lightweight

XML DTDs based on the World Wide Web Consortium’s XML standard. Ariba

sees it as a faster means to adopt XML specifically for electronic commerce

applications.

Micropayments and Product Unbundling

- payment mechanism for individual product pricing, allowing short-term

purchases and offering more choices. Digital coins and smart cards have

received much attention for their cash-like anonymity. A more compelling

economic rationale for micropayments, however, is their role in enabling

short-term contracts and quality-assured intermediation. Product customization

means the finest market segmentation. A flexible and profitable product

selection strategy would enable firms to charge the maximum price.

The primary argument against micropayments

is based a perceived preference for subscription and bundling, such as

newspapers and cable programming. However, the reasons for this preference

are more technological than economic. Cable system operators have traditionally

used "take-it-or-leave-it" marketing, being content with charging monthly

fees for a given number of channels, and not invested in elaborate billing

systems like the telephone companies. If cable operators had invested in

the necessary technologies and equipment to support detailed billing, they

would have been well prepared to offer more choices to their subscribers

beyond a few tiers. Even with a few tiers, an empirical test shows that

two-tier cable systems can charge 15% to 20% more for the same cable service

than one-tier systems. The increased price and profit comes from market

segmentation (Choi 1996). Profits increase as the segmentation becomes

finer. If technologies were not cost prohibitive, there would be finer

differentiation and market segmentation even in newspaper production and

delivery.

Despite this clear trend toward unbundling,

microtransactions and micropayments are dismissed in the digital marketplace

in favor of selling large bundles in aggregated bills without encouraging

a market for information on demand, small applets or your personal columns.

Large digital content providers are engaged in a two-pronged strategy for

electronic commerce. On the one hand, they don't see any commercial value

in the exploding information offered via millions of World Wide Web homepages.

That's bad news for those individuals who wish to cash in by selling bits

of information. On the other hand, these large companies are developing

technologies to measure and control usage so that every bit of use will

be metered and billed for their software and information products. If you

are a small player and have no links to large payment clearing service

providers, there will be no way of billing visitors to your homepage.

In cross-industry application micropayments open up a whole range of

new possibilities. Firms can be established that bundle orders for other

firms, offering them the same products at prices that would never have

been possible before. With microtransactions electronic intermediaries

can offer their services on pay-per-view basis to small companies that

cannot afford the full service plans. This is especially valuable to firms

that deal with commodity-like goods since profit margins are typically

small and large capital investments in information technology present risks

that they are often not willing to face.

Standards

CommerceNet

is

a non-profit industry association for companies promoting and building

electronic commerce solutions on the Internet. Members include more than

500 companies and organization worldwide representing the leading banks,

telecommunications companies, online services, software and service companies,

as well as end users, who together are transforming the Internet into a

global electronic marketplace.

ClearCommerce

the leading provider of packaged and modular online transaction processing

software for Internet purchasing, announced September 9, 1998 that it has

established an E-commerce Advisory Board. The board is comprised of e-commerce

experts from @Home Network, Chase Manhattan Bank, The e-tailing group,

First Data Merchant Services, J. Crew and ZDNet who represent the hosting,

financial, consulting, retail, and publishing industries. The cross-industry

advisory board will discuss and promote standards to accelerate the migration

of businesses to online selling and transactions. In early fall, the board

will deliver to the e-commerce community significant work surrounding issues

that impact the industry.

Payments Mechanisms

Commerce One, Inc. and Signio, Inc., a leading provider

of e-commerce payment connectivity and services, announced a strategic

partnership to integrate Signio's Internet payment platform with MarketSite™,

on October 6, 1999. This enables Commerce One to provide a broad range

of enhanced electronic payment services to streamline electronic payment

processing for all MarketSite trading partners. Customers and trading partners

will have access to real-time consolidated payment services for credit

cards; debit cards; procurement card (P-card) authorization and capture;

digital checks; and automatic clearing house (ACH) transactions. These

payment services enable buyers and suppliers to automate commerce and increase

efficiencies by replacing traditional paper-based payment processes with

an end-to-end integrated payment processing capability, reducing the cost

and time associated with traditional billing methods.

In addition, Commerce One and Signio have agreed to collaborate to define

XML based payment documents utilizing components from Commerce One's Common

Business Library (CBL) 2.0. This collaboration is expected to help further

drive the definition of common payment document standards across

key XML industry initiatives. Signio will leverage Commerce One CBL 2.0

elements, XML document framework and XML tools as a basis for its own XML

schema-based product development efforts.

Ariba, Inc. and U.S. Bancorp, the largest provider of

purchasing cards in the world, announced an alliance to develop an integrated

electronic buying and payment infrastructure for business-to-business eCommerce.

U.S. Bank currently provides purchasing card programs for more than 500

corporations and government clients.The joint solution delivers fully electronic

orders and invoices, automatically reconciles purchase orders with purchasing

card charges, and integrates purchase data with the buyer’s financial systems,

enabling businesses and their suppliers to streamline commerce, reduce

operating costs and increase internal efficiencies by replacing paper-based

payment processes with integrated electronic payment systems.

As part of the alliance, U.S. Bank will become the preferred provider

of business-to-business payment services to buyers and suppliers on the

Ariba

Network. Additionally, Ariba will become the preferred provider of

business-to-business eCommerce solutions to U.S. Bank customers. The two

companies will work together to jointly market and sell their combined

solutions.

This integrated solution has been successfully implemented at numerous

organizations, including Hewlett-Packard Company, Boehringer-Ingelheim

and Visa. It is designed to eliminate much of the traditional, labor-intensive

paperwork associated with payment processes between buyers and suppliers.

These processes include suppliers’ invoice creation and distribution and

buyers’ invoice-to-order matching, check-writing, and check distribution.

By reducing the cycle time between order and payment, suppliers receive

payment more quickly. Buyers benefit from increased management control

over purchasing and increased savings from channeling purchases to preferred

suppliers.

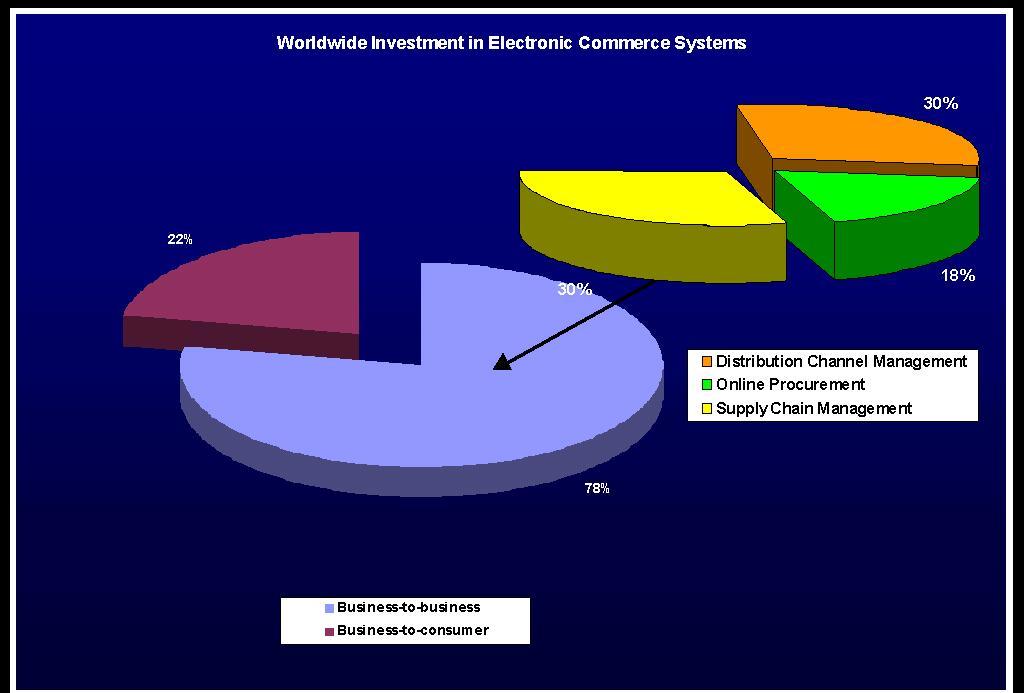

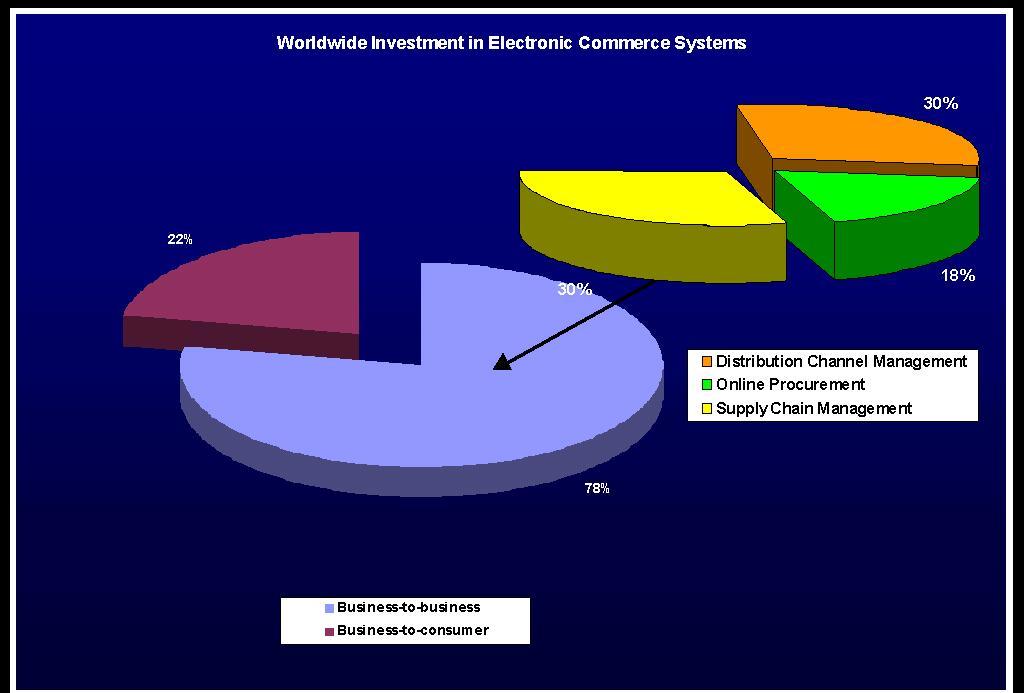

Worldwide investment in

electronic commerce systems

-

Projected to grow from $187 million in 1998

to $8.5 billion in 2003 ( Treasury & Risk Management, August 1999)

-

E-commerce software investment estimated $2.8

billion by 2002, up from $167 million in 1997 (Datamonitor, June 25, 1999)

Towards Opens Trade

Framework for

Global Electronic Commerce is a draft policy developed by interagency

working group that has been meeting for eight months, analyzing the issues

and consulting with academics, business representatives, consumer groups,

and members of the Internet community. Electronic commerce has the potential

to revolutionize trade in this area and others by lowering transaction

costs dramatically and facilitating new types of commercial transactions.

Many businesses and consumers are still wary of conducting extensive business

in cyberspace because of the lack of a predictable legal environment governing

transactions and resulting concerns about contract enforcement, intellectual

property protection, liability, privacy, security, and other matters. Another

concern of Internet users is the possibility that governments will impose

disparate and extensive regulations on the Internet in areas such as taxes

and duties, content restrictions, and standards.

Major policy recommendations include:

-

Fostering the Internet as a Non-Regulatory, Market-Driven Medium

-

Ensuring a Transparent and Harmonized Global Legal Environment

-

Allowing Competition and Consumer Choice to Shape the Marketplace

Link to White House

Site

Open Buying on the Internet (OBI)

Consortium was formed out of a roundtable of a number of Fortune

500 buying and selling companies who met to create an open, vendor-neutral,

scaleable, interoperable and secure standard for conducting business-to-business

(B2B) electronic commerce in October, 1996. Companies involved in developing

the OBI standard were driven by a shared vision to facilitate the rapid

implementation of Internet-based electronic commerce solutions utilizing

interoperable, standards-based Internet purchasing systems that are characterized

by:

-

universal, high-speed access

-

inexpensive and paperless information and transactions

-

platform-independent software and services

Goal: to increase efficiency, reduce costs, improve overall buy/sell

process, and increase service levels to customers and end-users. Adoption

of the standard will provide companies with a secure, common method for

conducting business online, enabling them to realize the full potential

of the Internet as a platform for B2B commerce. Continuing to develop the

standard, international support and inclusion of XML are among the planned

enhancements.

Members

The OBI Consortium now has over 60 member companies and continues to grow.

Link

to OBI

Closed Trading Tendencies

In spite of these initiatives, some critics say that B2B E-commerce

will only encourage closed trading communities over the next five years.

While a restricted market is needed to ensure efficient online trading,

this will also reinforce established partnerships. The results will be

1) increase in demand for private IP networks 2) greater business opportunity

higher up on the commercial services chain.

Virtual Private Networks (VPN) are a compromise between the security

features of EDI and the cost / time savings of Internet technology. Companies

can set up encrypted links with known trading partners within hours instead

of months. Additionally, VPN offers a solution flexible enough that it

can be scaled to support a wide range of needs from small suppliers to

even the largest trading networks. Turnkey service providers further simplify

the problems of network complexity and compatibility issues associated

with having diverse business partners using varying technologies, especially

those that need to cross international borders.

This report was completed in October 1999 for the class

International

Electronic Commerce taught in

the program of Management

Of Global Information Technology at the Kogod

School of Business

at American University

in Washington D.C.

Home

| Industry

| Traditional

Intermediaries | Electronic

Intermediaries | Emerging

Trends | International

Intermediaries | References

| About

the Authors | Links